- Home >

- Web Help >

- SeekerWorks™ >

- My Info/General Info - My Expenses

My Info/General Info - My Expense Reports

Use the My Expense Reports function to acquire Employee Expense Report information electronically from each employee as well as the ability to print and sign each report and attach any receipts. This fulfills the Accountable Plan requirements for expense substantiation that avoids having those expenses become income taxable and payroll taxable income to the employee. (NOTE: While this feature is included in SeekerWorks™, you'll need at least one copy of SeekerWorksPLU$™ to create and assign an employee to a User-ID.)

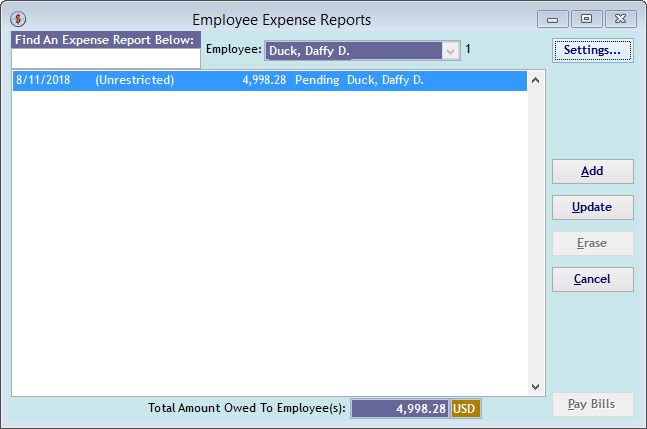

The "Employee Expense Reports" screen shows all of the weekly Expense Reports already created for an Employee, based upon their User-ID, and whether they're pending for posting or not. Once posted, the information becomes unchangeable and ready for payment. Use the (Settings...) button to define mileage rates and their effective dates as well as the G/L Account information (if you have security to see or change it).

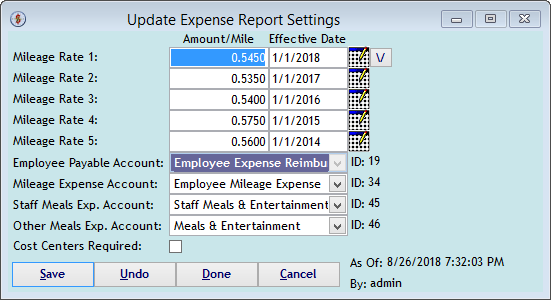

The "Update Expense Report Settings" screen shows mileage rates and their effective dates as well as the G/L Account information for the Employee Payable Account, the Mileage Expense Account, and the expense accounts for Staff Meals or Other Meals (e.g., with non-staff people or travel meals).

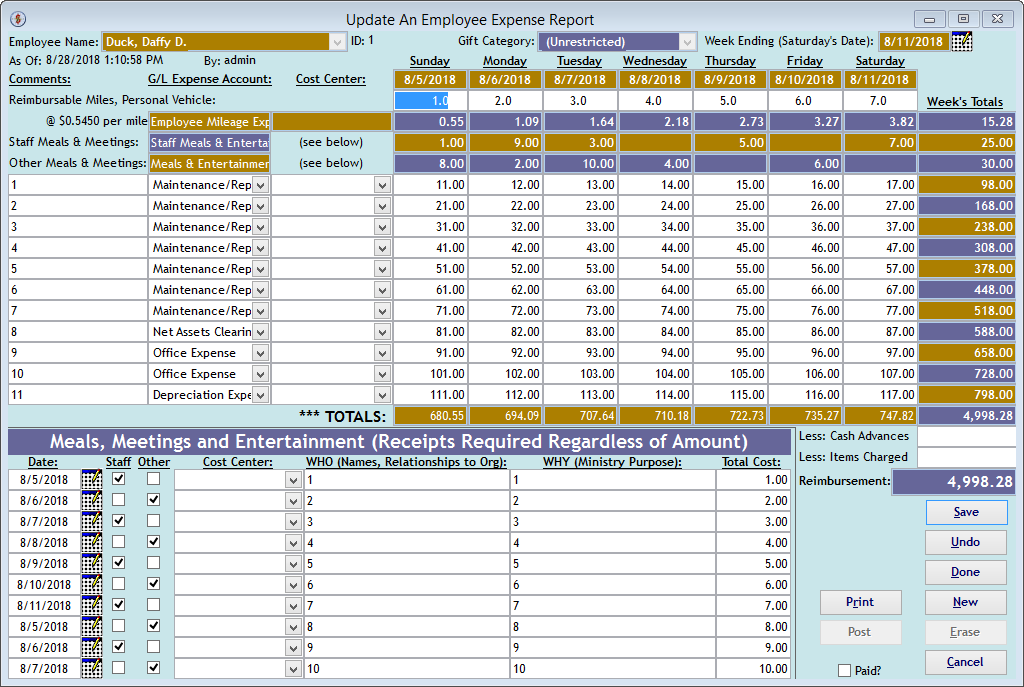

The "Update An Employee Expense Report" screen is used to view or update an Employee Expense report for a particular week. Enter the number of miles you drove for organizational purposes as an employee of the organization and any other reimbursable expenses pertinent to the week.

Print the report and sign it, then attach any receipts that substantiate your expenses to the form. Lastly, click (Post) if you have security for it to post the information to the General Ledger and Employee Sub-Ledger.

Right side navigation links:

More Screens:

People:

Gifts/Pledges:

My Info/General Info:

My Expense Reports